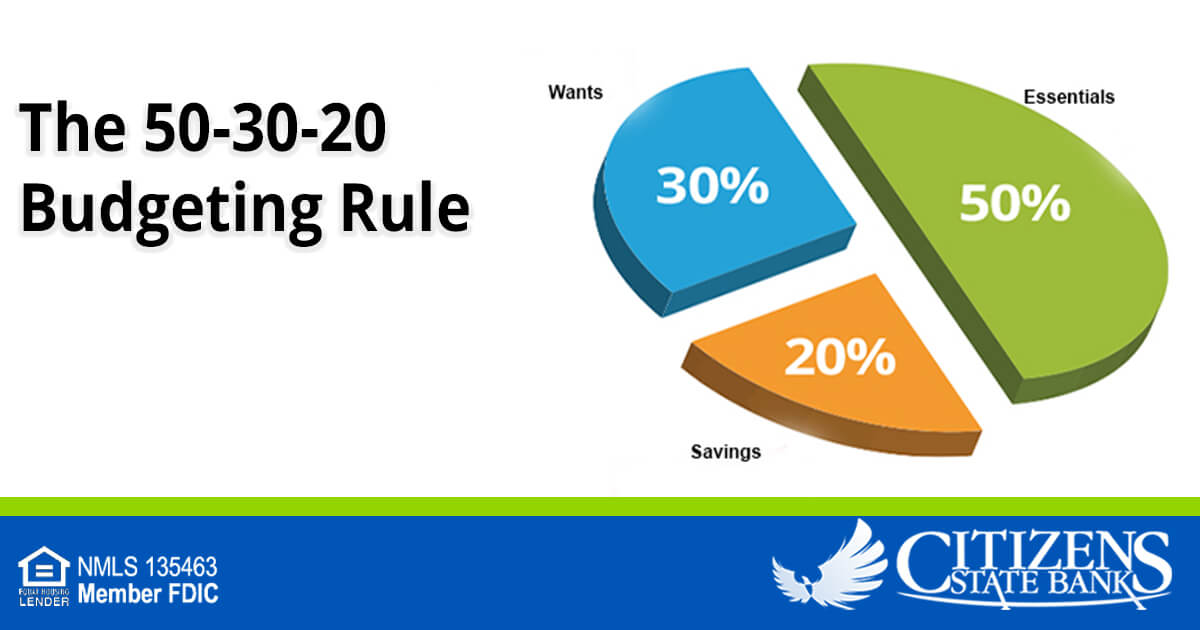

The 50-30-20 Budgeting Rule

March 10, 2023 •Leah Driver

There are as many ideas about budgeting as there are financial writers. While it’s important to find a system that works for you, the 50/30/20 rule is an easy way to start. What is the 50/30/20 rule? In a nutshell, it’s a system where you spend 50% of your after-tax income on Needs, 30% on Wants, and 20% on Savings.

To get started, you need to determine your after-tax income, a.k.a. your bring-home pay. This is the amount of your paycheck after taxes, insurance premiums, retirement contributions, and any other deductions from your gross pay. If you’re self-employed, your after-tax income is equal to your gross income less your business expenses.

"Essentials"

The next step is to limit your needs to 50% of your after-tax income. What is considered a NEED? These are your essential expenses like rent/mortgage, utilities, car payment, credit card payments, groceries, insurance premiums, medication costs, etc.

An easy test to determine a NEED vs. a WANT is the pain factor. The more painful it is to give something up, the more likely it is to be an essential. Not making your car payment, and ultimately losing your car, is much more painful than losing a streaming service. Therefore, your car payment is a NEED, while your streaming bill is a WANT. (No one said you wouldn't really miss your wants. 🙂)

Determining "Wants"

Speaking of WANTS, they should total around 30% of your after-tax income. This might sound like a large portion of your budget, but let’s focus on what a “WANT” is. One example ― the internet portion of your cable bill might be a NEED (if it's necessary for work or school), but the package that includes premium channels is most likely a WANT. Same with splurges at the grocery store, on clothing, eating out, etc. It’s easy to exceed 30% pretty quickly. (And if you're able to keep your WANTS at under 30%, there's no law that says you can't contribute more than 20% to SAVINGS.)

Savings

That leaves 20% to spend on SAVINGS and/or debt repayment. (Debt repayment can be tricky. If your car payment is $200, but you pay $300 each month, $200 would go into NEED while $100 would go into debt repayment.) Your first priority is building an emergency fund. (You should have anywhere from 3 – 6 months of living expenses in an easily accessible savings account to cover any emergencies that might come up.)

Prioritizing after you have an emergency fund is more subjective. If you have high-interest debt, try to refinance/transfer your balance to the loan with the lowest interest rate you can find, then concentrate on paying it off. If you're not comfortable with 6 months of living expenses in your emergency fund, aim for 12.

An Example of the 50/30/20 Plan

If your monthly take-home pay is $3,500, using 50/30/20 means no more than $1,750 should go towards your monthly Needs.

| 100% of Income = $3,500 | |||

| 50% = $1,750 | |||

| 30% = $1,050 | |||

| 20% = $700 | |||

Disclaimer: This calculator is provided by a third party for educational purposes only. Citizens State Bank is not responsible for the accuracy or completeness of the results. Using this tool does not constitute an offer, representation, or guarantee by Citizens State Bank for any product or service. We recommend consulting a Citizens State Bank representative for personalized advice. Citizens State Bank is not liable for any actions or decisions made based on the information provided by this calculator.

That means spending $1,500 on your rent/mortgage payment is probably out of reach unless your NEEDS (insurance, utilities, etc.) are less than $250 each month. If you're already spending $1,500 on housing, you'll have to see if you can reduce your payment or the cost of other NEEDS to stay within the 50% range. If you can’t come in at 50% or less, deduct money from WANTS to make sure your NEEDS are covered. (Always "borrow" from WANTS before SAVINGS.)

You should then take 20% ($700) for SAVINGS and debt repayment. We’re listing this before WANTS to stress how important it is to pay down your debt and to save money. (It’s estimated that at least 40% of Americans can’t come up with $400 in case of emergency, and we don’t want that to be you.)

Finally, if the other categories are on-target, you have $1,050 to spend on your WANTS. Have fun but be careful ― money never seems to go as far as we’d like.

If you need help putting a budget together, don’t hesitate to contact a Personal Banker. They can talk with you to determine a plan that helps you reach your financial goals.

The views, information, or opinions expressed in this article are solely those of the author and do not necessarily represent the views of Citizens State Bank and its affiliates, and Citizens State Bank is not responsible for and does not verify the accuracy of any information contained in this article or items hyperlinked within. This is for informational purposes and is no way intended to provide legal advice.