Regular credit card use can be like playing with fire; it's great if you know what you're doing, but if you don't, the damage can be long-lasting. Here's some information to keep in mind about your credit cards and use.

Charge only what you can afford.

This seems obvious but using a credit card can feel like spending "free" money. Keeping a running tally of what you've spent can help keep you from getting carried away.

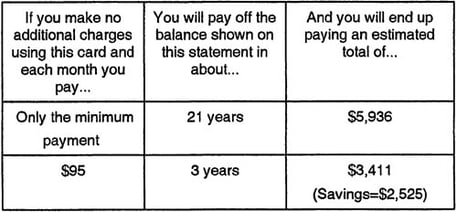

Pay your credit card in full each month.This is always optimal, but if you can't pay your entire balance...

Nothing will ding your credit score faster than late payments.

Don't take a cash advance.There are a few reasons for this - first, the interest rate on cash advances is usually higher than the rate charged for purchases. In addition, interest starts to accrue as soon as you receive the advance, unlike purchases that involve a grace period.

Negotiate your terms.If you have a history of responsible credit card use, don't hesitate to ask for a lower interest rate, or to have fees (such as annual fees) waived.

Consolidate credit card debt on a low interest card.If you have balances on multiple cards, transfer them to the account that charges the lowest interest rate. If that's not possible, experts recommend focusing on repaying the card that charges the highest interest rate first.

Check your monthly statement.Mistakes can happen, so be sure to compare your monthly statement to your credit card receipts. If you find a discrepancy, contact the credit card company immediately.

Information Resources

CFPB (Consumer Financial Protection Bureau)

Wikipedia

The Citizens State Bank Visa offers*

*Subject to normal credit standards. Offer subject to change without notice. Six-month interest-free period begins on the first balance transfer date. After six months, the interest rate on remaining transferred balance will adjust to 12.48% (Gold) or 17.92% (Classic). Late fees and penalties still apply.

The views, information, or opinions expressed in this article are solely those of the author and do not necessarily represent the views of Citizens State Bank and its affiliates, and Citizens State Bank is not responsible for and does not verify the accuracy of any information contained in this article or items hyperlinked within. This is for informational purposes and is no way intended to provide legal advice.