Deciding whether you should open a joint bank account might not be as straightforward as it seems. Joint bank accounts provide equal access to all account holders, which means anyone can withdraw money or view the complete account history. Before you open a joint account, consider the pros and cons so you can determine what’s best for you.

Who Should Open a Joint Banking Account?

Joint bank accounts offer a level of convenience and flexibility that isn’t possible with separate bank accounts. Many joint accounts are opened by married couples of people in committed relationships to merge their finances. This is a big step for most relationships as it forces partners to manage their money with the other person’s perspective in mind. It’s best not to assume you’ll open a joint account, and instead have a discussion to ensure you’re on the same page with the way you handle your money and share financial goals.

Joint accounts are also a great solution for helping someone manage their money. Parents will often open joint accounts with their children as a way to teach money management and healthy financial habits. It’s also handy to have a joint account so parents can deposit funds when their kids are away at school.

Joint accounts are also useful for individuals with aging family members who might need help overseeing their finances. If you have access to their account(s), you can monitor their balances, ensure bills are being paid, and look for account fraud.

The Benefits of a Joint Bank Account

Convenience: The biggest benefit to opening a joint banking account is convenience. Co-owners have equal visibility and responsibility for money management, making it easier to pay for joint expenses like groceries, utilities, and rent. It’s also easier to identify and eliminate duplicate costs. (For example, both people might have a streaming service subscription when only one is needed.) A joint account also makes it easier to set up and stick to a budget.

Can Encourage a Sharing Mindset: Paying bills from a joint account can eliminate a “yours vs mine” mentality. (“I pay the cable bill, so I should get to choose what we watch.”) This is especially important for couples as they’re getting started.

Money is Accessible if One Partner is Incapacitated: A joint account means one partner can access funds without a power of attorney or other legal documentation in the event the other partner is debilitated.

My wife trusts me with a joint bank account but when I’m loading the dishwasher she always walks in the kitchen “to get something.” - @DanRegan_Comedy

The Risks of a Joint Bank Account

Different Thoughts on Handling Money: Everyone has their own idea on the best way to manage spending and saving money. Perhaps one partner likes to keep a cushion in the account while the other doesn’t want to keep any more than necessary. Unless they can reach a middle ground, this can cause disagreements and strife. It’s best to figure out where you agree and move forward from there.

Lack of Privacy: Account co-owners have equal access to the account history and transactions, like payments, withdrawals, and balances. If one partner has something to hide or doesn’t like the thought of every purchase being monitored, this can create issues.

Makes it Difficult to Escape Financial Abuse: A study by the Center for Financial Security suggests that 99% of domestic violence cases include aspects of financial abuse. When all funds are in one account, it’s easy for an abuser to immediately know when their victim is trying to get away.

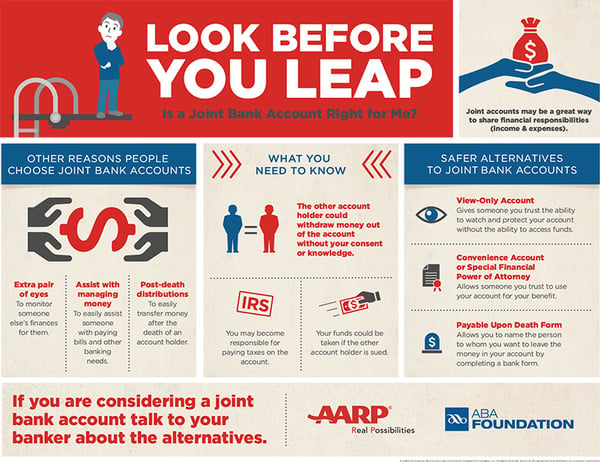

Infographic developed by the AARP and the ABA Foundation:

Why Some Couples Might Want Separate Bank Accounts

One Person has Severe Debt or Other Financial Obligations: If one partner is debt-free while the other has major debt and a low credit score, having a joint account might not be a good idea. Likewise, if one partner has family obligations, such as child support, separate accounts can keep those payments outside of your joint budget.

You Want Separate Accounts: Joint accounts aren’t for everyone, and it’s possible you and your partner may decide it doesn’t make sense to combine finances. You can compromise and maintain your personal account(s) and open a joint account, or you might not open a joint account at all.

While these are general points to aid in the process of deciding if a joint account is right for you, they are not conclusive. Talk to your partner and decide what is best for the both of you.

The views, information, or opinions expressed in this article are solely those of the author and do not necessarily represent the views of Citizens State Bank and its affiliates, and Citizens State Bank is not responsible for and does not verify the accuracy of any information contained in this article or items hyperlinked within. This is for informational purposes and is no way intended to provide legal advice.