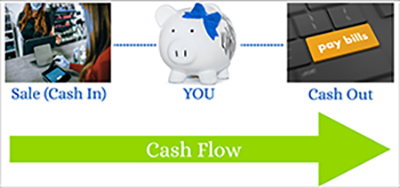

When you started your business, you knew you’d have to make sacrifices and trade-offs, but you might not have realized how much time you’d spend worrying about cash flow. Cash Flow is defined as “the net amount of cash and cash-equivalents being transferred into and out of a business,” which basically means – are you making enough money to pay your bills? Here are some tips for conserving your cash and improving your cash flow.

Take advantage of software and mobile apps that allow you to view your bank account balances, your accounts payable and accounts receivable. This is the best way to identify potential issues before they become big problems.

It really doesn’t matter how great your sales are if you’re not charging promptly or if your payment terms are too lax. Send invoices when the job is completed or products delivered. Confirm the billing information before generating the invoice – precious time is lost when an invoice floats from desk-to-desk or inbox-to-inbox.

Consider incenting clients to pay early by offering a discount when payments are made before the due date or charging a fee when the payment is late. Require deposits or partial payments on large orders or long-term contracts. You should also evaluate your payment terms. Perhaps you’re allowing a 60 day payment window when 45 days would work better. (The shorter your payment terms, the faster you’re getting paid.)

While you’re reviewing your invoicing, take a look at your payment solutions. Do you accept credit or debit cards, and if not should you? Do you use payment apps or online payment methods?

Finally, stay on top of overdue invoices. It might not be comfortable to contact clients about past-due amounts, but it’s a necessity.

Negotiate favorable payment terms with your vendors, and support suppliers who are more flexible. Ideally, you can bill and receive payment from your customer before paying your bill. Be sure to pay your invoices on time to avoid late fees and to maintain a positive relationship.

It can be easy to underestimate the amount of money you have invested in your inventory. If you have excess product and need cash, or room, quickly, hold a sale. If you have inventory that you just can’t get rid of, talk to the vendor who sold it to you – perhaps they’ll agree to buy it back, likely minus an administrative or restocking fee. If not, discuss the potential benefits of donating the product with your tax advisor.

Evaluate your current space and consider downsizing to save on overhead costs. You might be consider renegotiating your rental agreement or subletting part of your space. Can you cut back on utilities or payroll? Are you spending money on subscriptions or services you’re not using?

If you own your equipment, be sure to stay current on repairs and maintenance to extend the life of your equipment. If you have equipment you no longer use consider selling it to generate quick cash. Talk to your tax advisor about leasing equipment instead of buying it – it’s a way to access the latest models while still expensing the lease costs on your taxes.

As with your personal finances, it’s important to review some costs, like loans and insurance, annually to ensure you’re familiar with your terms and have the best fit for you and your current circumstances.

A business line of credit is a good insurance policy against cash flow problems. You can use it to cover a lapse in cash flow for short periods of time – for example to pay bills while waiting on your accounts receivable. Just be sure not to borrow too much and have a plan in place to pay it back on time.

If you have more questions about cash flow, be sure to contact your bookkeeper, accountant, banker, or financial advisor. Like many topics, understanding cash flow on paper is relatively easy but it can be difficult to put that understanding into practice for your circumstances, especially if your business is subject to frequent changes.

If you're not sure who to talk to about Cash Flow, you can schedule a conversation with a CSB Relationship Manager. They can help you assess your current financial position and feel confident about making financial decisions.

The views, information, or opinions expressed in this article are solely those of the author and do not necessarily represent the views of Citizens State Bank and its affiliates, and Citizens State Bank is not responsible for and does not verify the accuracy of any information contained in this article or items hyperlinked within. This is for informational purposes and is no way intended to provide legal advice.