Most of us have a fundamental understanding of profitability - if a business is making more money in sales than it has to pay out to cover expenses, it's profitable. Profitability is typically an owner's primary goal, whether that "owner" is running a one-person business or is a stockholder in a large corporation. It's important to look beyond a simple dollar amount to determine profit, as it doesn't show why the business is profitable, or not. Analyzing key metrics can show if a business is healthy and their profitability is sustainable. Calculating and comparing metrics can identify areas that are working well, and which need improvement.

Using two common financials - an Income Statement and Balance Sheet - you can determine the following ratios, which in turn can help you make more educated investment decisions.

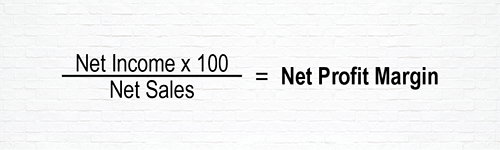

The most common measure of a company's profitability is the net profit margin. To use this equation:

- Find net income near the bottom and net sales near the top of the income statement.

- Multiply net income by 100.

- Divide the answer from Step 2 by net sales to get the net profit margin as a percentage.

Keep in mind, a larger profit margin doesn't necessarily mean a larger profit. If Business A has a 1% net profit margin and Business B's is 10%, Business A can still make more if their sales are higher.

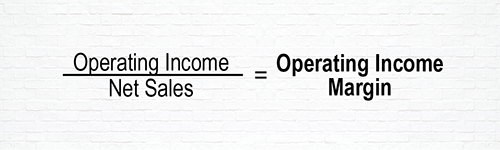

The operating income margin is different from the net profit margin because it determines income from operations, excluding costs and revenues that are used to determine net income.

- Find net sales at the top of the income statement.

- Find the operating income if it's listed on the income statement. If it's not listed, you can determine it by subtracting operating expenses and devaluation from the company's gross income.

- Divide the operating income by net sales to get the operating income margin.

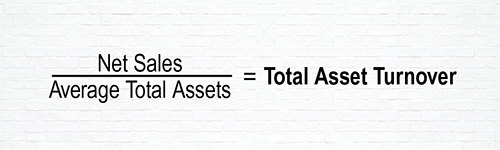

Total asset turnover will tell you how effective a company is at using their assets to generate sales. Assets that don't generate sales simply cost money, therefore this metric is an indication of how well a company manages its assets.

- Find net sales at the top of the income statement.

- Add total assets from the current year to total assets from last year, then divide that total by 2.

- Divide net sales by average total assets to determine total asset turnover.

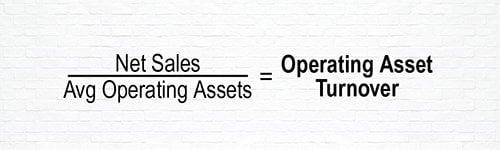

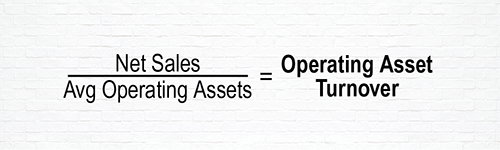

How effectively is a company using it's operating assets to generate sales? Operating asset turnover may be more reflective of a company's competitiveness in it's primary operations because it doesn't include all assets like total asset turnover.

- Find net sales at the top of the income statement.

- Find average operating assets by adding operating assets from the current year with the operating assets of the previous year and divide the total by 2.

- Divide net sales by average operating assets to determine operating asset turnover.

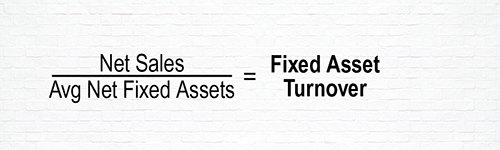

The fixed asset turnover tells how well a company uses their fixed assets, like property and equipment, to create sales. Trends in this ratio can help a business determine if it's time to expand production volume.

- Find net sales at the top of the income statement.

- Find average net fixed assets by using the balance sheets of the current and previous year - add the net fixed assets from each year and divide the sum by two.

- Divide net sales by average net fixed assets to find the fixed asset turnover.

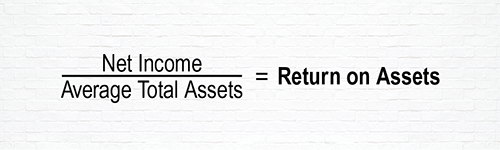

Return on assets show how effective a business is at using its assets to generate income, not just sales. In other words, if the company can use its assets to develop profitability, not just sales.

- Find net income near the bottom of the income statement.

- Use the balance sheets from the current and previous year to find average total assets by adding total assets from each year and dividing that value by 2.

- Divide net income by average total assets to get the return on assets.

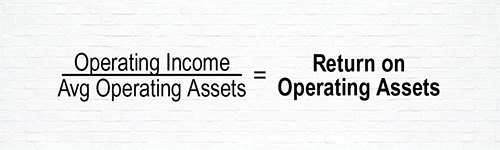

Return on operating assets focuses on a company's core operations and how effectively they use operating assets to generate income, not just sales.

- Using the income statement, subtract operating expenses and devaluation from gross income.

- Add together operating assets from this year's and last year's balance sheets and divide by two to determine average operating assets.

- Divide operating income by average operating assets to get the return on operating assets.

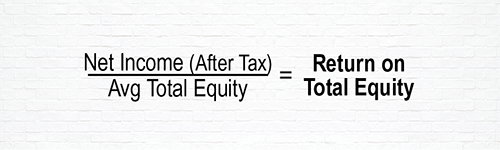

If you own stock, you can calculate the amount of income a company is able to generate with your equity by using the return on total equity metric. This ratio takes all equity into account, so if you're a preferred shareholder, this is the return on equity you want to know.

- Find net income after tax near the bottom of the income statement.

- Find the average total equity by using the balance sheets from this and last year, adding total equity and dividing the sum by two.

- Divide this year's net income after tax by the average total equity. This gives you the return on total equity.

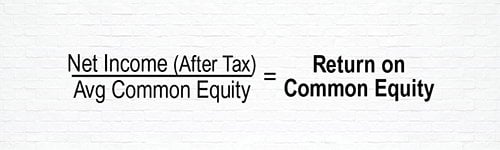

Return on common shares (or common equity) determines how much income a company can generate based on the value of its common stock. Return on common equity is an important ratio for any shareholder to know because it shows how well a company is performing in regards to the interests of those who hold equity.

- Find net income after tax near the bottom of the income statement.

- Find average common equity by using the balance sheets from this and last year. Add common equities from both years and divide that sum by 2.

- Divide the current year's net income after tax by the average common equity to find the return on common equity.

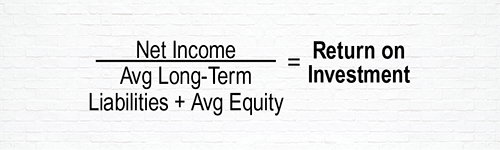

The return on investment (ROI) is a common measure that determines how well a company is using funds invested in purchasing the items necessary to make the company run to generate a profit. ROI determines if it's worth the funds invested.

- Find net income near the bottom of the income statement.

- Use the balance sheets from the current and previous year to calculate average long-term liabilities and average equity. To do that, add the long-term liabilities and the total equity from each year, divide the sum by two to get the total long-term liabilities plus average equity.

- Divide the current year's net income by the total long-term liabilities and average equity to find the ROI.

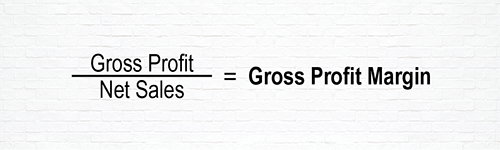

In order to remain in business, a company needs to know it can cover all indirect, as well as direct, costs involved with developing a product. The gross profit margin is a good indication, and is determined by:

- Find gross profit and net sales on the income statement.

- Divide gross profit by net sales and you'll have the gross profit margin.

A high gross profit margin is a good thing, while a low gross profit margin can mean the company is at risk of not being able to afford the costs of doing business. A low gross profit margin likely means it's time to increase the product's selling price or decrease costs.

Have questions?

If you have questions about profitability, request a financial assessment with a Relationship Manager. They can help you review your current position and help you make confident financial decisions.

The views, information, or opinions expressed in this article are solely those of the author and do not necessarily represent the views of Citizens State Bank and its affiliates, and Citizens State Bank is not responsible for and does not verify the accuracy of any information contained in this article or items hyperlinked within. This is for informational purposes and is no way intended to provide legal advice.