Everyone has room for improvement when it comes to their financial habits. Many, if not most, of us live beyond our means and have the debt to prove it. Following are some habits and behaviors we can address to help get - and keep - our spending in line.

Let’s start with saving money – we know we should do it, but many of us approach it in the wrong way. We get our paycheck, and we have the best intentions to move whatever money we have left after we pay our bills into savings. Using this approach, more often than not there’s no money left to save. The key is to “pay yourself first.” There are two easy approaches you can take – you can arrange with your employer to have a certain amount of your paycheck direct deposited into a savings account and the rest into checking OR you can set up a transfer that will move funds from your checking into savings automatically. After your system is set up, you’ll likely find you forget about the money going into savings.

If you don’t have a budget, overspending is easy. There are many ways to set up a budget, but the best system is one you’ll actually use. In general, when you set up a budget you’ll list your monthly expenses so you’ll know how to allocate your income. (Don’t forget annual expenses like taxes or insurance, along with savings and some money for discretionary purchases.) If your initial budget shows you’re spending more than you make, you’ll have to make adjustments. This is a time for complete honesty – ignoring overspending won’t make it go away.

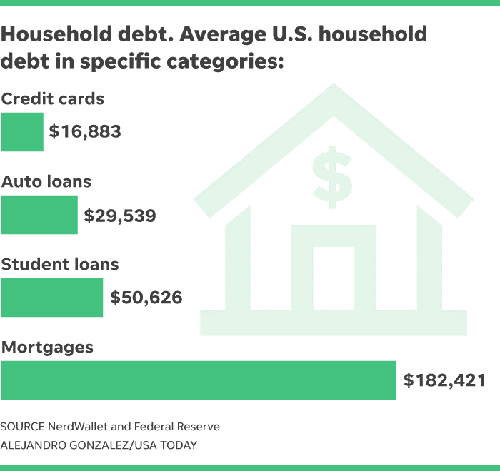

Surprisingly, the more money some of us make, the higher our debt payments as a percentage of our income. It’s an easy trap to fall into – you get a promotion along with a raise, so now you need (or deserve) to drive a nicer car, wear more expensive clothes, or buy a larger home. Or we see our friends going on pricey vacations, moving into larger homes, or buying the latest tech, and we feel like we need these things too.

It’s important to remember that it’s impossible to judge success from the outside. While we may envy our neighbor’s new luxury SUV, we don’t know how much debt they have, their income situation, how much they have in a retirement account, or their long-term financial goals. The only comparison you need to keep track of is how well you’re measuring up to the financial goals you’ve set.

This mistake is very common, and can really cost a lot over time. You put together your budget, including enough money to make the monthly minimum payment on all of your debt, and you’re sticking to it, but you’re not getting anywhere. Why? Because along with your budget, you need to put together a plan to pay off your debt.

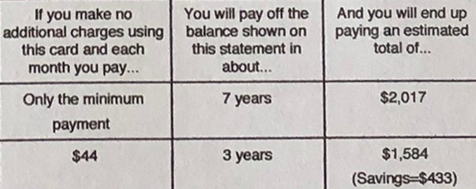

This box shows why you need a debt plan, and why you should allocate more funds than the minimum monthly payment in your budget. There are many debt repayment plans out there, but just like setting up a budget, the best approach is one you’ll follow.

To see how important it is to have a plan to pay off debt, take a look at this box on your own credit card statements - it's a real eye-opener.

If debt becomes a problem, it’s very easy to try to wish it away – perhaps you’ll win the lottery, learn about an inheritance from an unknown wealthy relative, or get a new job that will quadruple your salary. Fantasies like this are fun, but it’s important to remember that you have the power to change your habits and get a handle on your debt and it is doable – the internet is full of inspirational stories of people who have paid down a seemingly overwhelming amount of debt.

Obviously, the earlier we address our bad habits, the less likely they are to cause us problems. Just like the habits themselves, solutions will vary from person to person and by circumstance. However, it’s important to recognize our behaviors, and understand there are options for improvements. To learn more, look for a mentor or advisor, search the internet, or visit your local library. If the number of options is overwhelming, don’t hesitate to ask your banker for advice.

The views, information, or opinions expressed in this article are solely those of the author and do not necessarily represent the views of Citizens State Bank and its affiliates, and Citizens State Bank is not responsible for and does not verify the accuracy of any information contained in this article or items hyperlinked within. This is for informational purposes and is no way intended to provide legal advice.