There’s no way around it, making financial decisions is intimidating. “

Am I making a mistake? Is this the best value for my money? How do I know how much I need to retire? Is the person I’m working with reliable? Knowledgeable? Trustworthy?” Sometimes it’s easier to do nothing. Here are some tips to help you make choices you feel good about, breaking the decision-making process down into steps that are more manageable and less intimidating.

There’s no way around it, making financial decisions is intimidating. “

Am I making a mistake? Is this the best value for my money? How do I know how much I need to retire? Is the person I’m working with reliable? Knowledgeable? Trustworthy?” Sometimes it’s easier to do nothing. Here are some tips to help you make choices you feel good about, breaking the decision-making process down into steps that are more manageable and less intimidating.

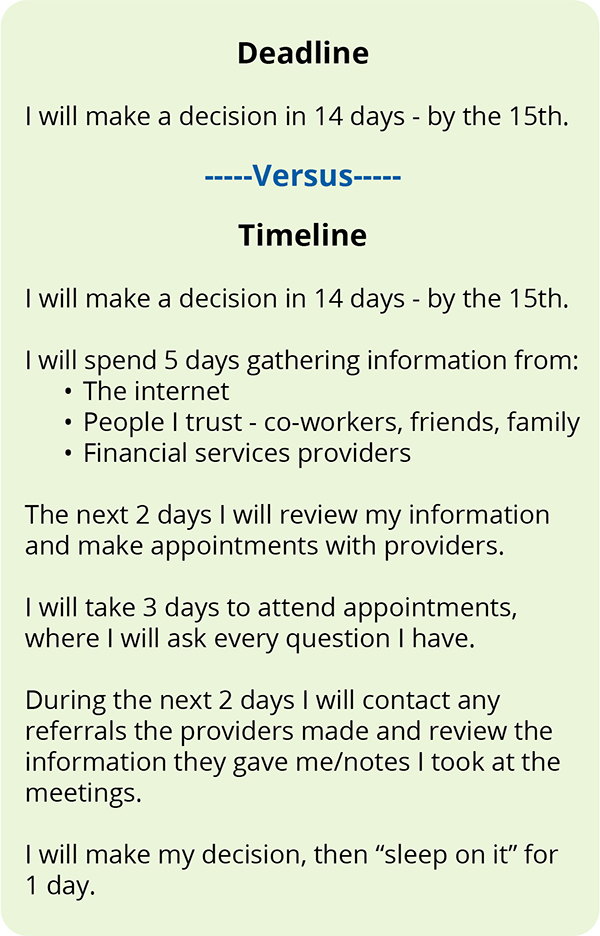

First, take your time. Sometimes there are legitimate deadlines (signing up for insurance before the enrollment period ends), and in those cases start the process early. Don’t pressure yourself, and don’t let others pressure you. Tell salespeople up front that you’re looking for information and won’t be making a decision immediately. If they’re not willing to talk to you without the promise of a quick sale, walk away. Of course, taking your time doesn’t mean procrastinate. Set a timeline for yourself, not just a deadline, and stick to it.

As you can see in this graphic, use your time to do your homework. If you’re considering your first mortgage, learn as much as you can about mortgages. (The same process would apply to life insurance, retirement accounts, stock brokers, etc.) Look online, talk to people you know and trust, contact bankers, realtors or others who know about mortgages. Ask your employer if they provide any resources or assistance that would be helpful.

While doing your research, you'll find companies or salespeople you'd like to interview. Schedule appointments, and when you meet be sure to ask all of the questions you have. Using the mortgage example, ask why you should use that lender; specifics about fees and charges; what you need to know about deadlines; paperwork needed; ask yourself if you’re comfortable with the lender, etc.

Evaluate and verify the information the salespeople give you. Continuing with the mortgage example, if the lender gave you referrals, contact them. Ensure the information they gave you agrees with the information you learned on your own. If one lender gave you wildly different information – for example a much lower interest rate – investigate why/how they’re able to do that, and determine if the offer is legitimate.

After you've verified the information, evaluate potential outcomes. Perhaps you’ve narrowed your search to two mortgage lenders – one recommends a 15 year mortgage with a lower interest rate and higher monthly payment while the other recommends a 30 year mortgage with a higher interest rate but lower monthly payment. Can you afford the higher monthly payment? Can you make a monthly payment for the next 30 years? What happens if you can’t afford the higher payment? Or if you’d planned to retire in 20 years, not 30? Which seems to be the best fit?

After answering these questions you should feel fairly comfortable making a decision. Sometimes it’s hard – does anyone really know how much money they’ll need for retirement – so it’s important to evaluate your decision periodically to make sure you’re on the right track. Continuing with the mortgage example – examine your mortgage from year-to-year to make sure it’s still the best option. Market conditions, interest rates, and home values change – these are good reasons to consider a new mortgage. No matter what type of financial decision you’re making, staying involved and evaluating the results periodically is definitely in your best interest.

The views, information, or opinions expressed in this article are solely those of the author and do not necessarily represent the views of Citizens State Bank and its affiliates, and Citizens State Bank is not responsible for and does not verify the accuracy of any information contained in this article or items hyperlinked within. This is for informational purposes and is no way intended to provide legal advice.